How CSU Students Can Prepare for the Next Recession

Even with little money and a lot of student loan debt, you can protect yourself

Seeing the headline for this article may have made your heart skip a beat, but there’s no need to panic — recessions are notoriously difficult to predict, and nobody can say with certainty when the next one will occur or how bad it will be. However, just as storms are a fact of weather, recessions are a fact of economies, and a recession will happen sooner or later. There are reasons to believe that another recession is just around the corner.

Ben Leubsdorf wrote for The Wall Street Journal, “The economic expansion that began in mid-2009 and already ranks as the second-longest in American history most likely will end in 2020 as the Federal Reserve raises interest rates to cool off an overheating economy.” Leubsdorf was referring to a survey conducted by The Wall Street Journal in which about 60% of economists surveyed predicted that a recession would occur in 2020, and 20% predicted it would occur in 2021. In addition, economist Russ Roberts of Stanford University’s Hoover Institution has stated that “if the trade war between the U.S. and China and the U.S. and Europe intensifies, it can lead to a recession.”

Even though nobody knows for sure when the next recession will be or how severe it will be, the time to prepare for it is now, while economic times are relatively good. “With 8 Years of Job Gains, Unemployment Is Lowest Since 1969,” said a 2018 New York Times headline for an article by reporter Ben Casselman. “By almost any measure,” wrote Casselman, “the American economy is humming. Gross domestic product is on pace for its best year since the housing bubble of the mid-2000s. Consumers and businesses are the most confident they have been in years, if not decades. Stock market indexes are near record highs.”

Unfortunately for college students, who tend to have little money and a lot of student loan debt, some of the most common advice on how to prepare for a recession is to save up half a year’s worth of living expenses and to pay off debt. Fortunately, however, there are ways to prepare for a recession that don’t require a full-time income:

1. Network professionally

You may not have much money right now, but CSU is an epicenter of great professional connection opportunities. You have access to classmates, professors, visiting speakers, organization members, and all the participants in campus events. Don’t waste this precious opportunity to meet ambitious and accomplished people and get their contact information. One of the easiest ways to build a professional social network is with Linkedin, which is free! Create an account ASAP, start adding people, and look up guides on how to make your account look attractive to potential employers.

2. Network Informally

Having friends who are willing to trade favors with you is a powerful form of wealth. The thing about friendship, though, is that it requires trust, and trust takes time to build. If you wait until times get tough to find a mutual friend-in-need, you may each have doubts that the other person will fulfill their end of a bargain, or worse, that they won’t hurt you in some way. Either find some good people you can count on or work on the relationships you already have so you’ll each know who to go to in times of need.

3. Get a job or make the most of the one you have

The Great Recession of 2008 devastated many people who had little to no work experience. Businesses trying to save money became pickier about who they hired, leaving many practically locked out of the world of work.

If you’ve never worked before, seriously consider getting a part-time job while you’re in school. Many of the most high-potential, entry level jobs are available exclusively to college students. If you already have a job, be mindful of the quality of your work. Be so productive that your employer would be reluctant to lay you off. Advance if you can, as it will give you a competitive advantage later.

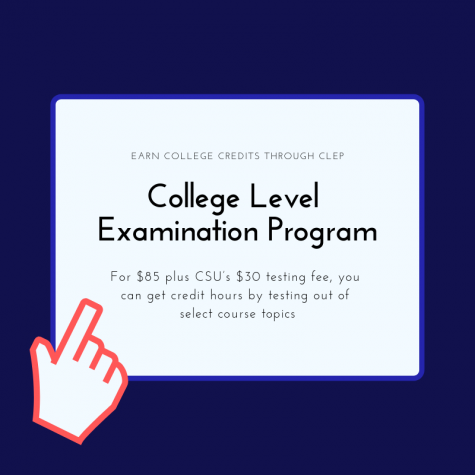

4. Diversify your skill set

Diversifying your skill set lowers your risk of unemployment. If the next recession causes mass layoffs in the field you specialize in, you and thousands of people with the same skills may have to compete with each other for jobs that involve those skills. If you can do something that most of the people in your field cannot do, you’ll have access to jobs that are out of their reach. Diversifying your skill set can even keep you from being laid off if your employer has a use for your extra skills. For example, if you’re a journalist who can also do web development, your employer may see you as a two-for-one deal because you can both work on their website and write news for it.

You may be thinking to yourself, “But I’m BUSY. Where am I going to find the time to learn a new skill?” Well, you have to take electives, don’t you? Why not kill two birds with one stone- take one class or more that will teach you job skills and be that much closer to graduation. Here are some course suggestions for the upcoming spring semester:

- “Introduction to Digital Design” with Professor Elizabeth McFalls — Makes you learn Adobe Illustrator and Photoshop, which can be used in marketing, advertising, magazines, and more.

- Any foreign language class applicable to your field — Consider Spanish if you want to work with people in the United States, consider Arabic if you want to work for the military, consider Mandarin Chinese if you want to go into international business, and so on.

- “Writing in the Workplace” with Professor Joseph McCallus — A well-rounded workplace writing class that will teach you how to write professional emails, how to make a better resume, how to write proposals, and even how to do some technical writing.

- “Advertising Writing” with Professor Joseph McCallus — CSU’s course description describes it as the “study of and practice in advertising writing for a variety of media, including television, radio, magazines, and newspapers.”

- Various computer science classes — Ask your advisor what’s allowed with your major.

To choose the courses that are right for you, tell your advisor that you are looking to diversify your skill set and ask them for course suggestions.

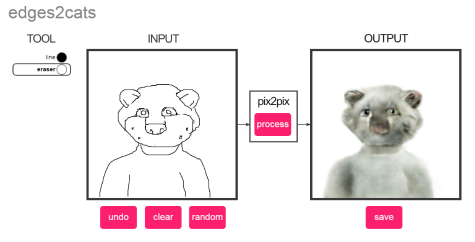

5. Design an emergency side hustle or business

Sometimes you have to create your own opportunities, and this is especially true during recessions. What would you do if you were underpaid or unemployed and seemingly stuck that way? You can mitigate the risk of this happening by having an emergency business plan. There are services that the average person can provide that are almost always in demand, such as babysitting, dog-walking, and yardwork. To sell products, there are online venues such as Ebay and Craigslist. If you have a creative streak, you can sell homemade items on Etsy, and if you can draw, there are various places online where you can sell commissioned art. Write down a list of things you know how to do that people might pay money for, and use that to come up with your emergency business plan.

Of course, money saved is money earned, and you could take the alternative route of doing something that saves you a lot of money. If you have land, you can save a lot of money by growing your own food. If you decide to go this route, be sure to develop your green thumb so you can rely on it later. You can also sell what you grow! Also, if you can split the rent with a roommate (or more roommates than you have now), that is an easy way to free up some money for other needs.

6. Learn some soft skills while you’re at it

College fills your head with knowledge, and that’s great. However, college students tend to study brainy subjects such as computer science, medicine, business, and the like. In the real world, you need people skills and common sense, things that don’t come to everyone naturally. Study these things so you won’t have to suffer through the School of Hard Knocks during a recession.

Do not assume that customer service and sales are beneath you just because you’re studying for something more prestigious. If you get a job in either of these while you’re in school, consider the job paid training and make the most of it. You’ll learn transferable skills you can use in any industry.

You probably already have a lot of studying on your plate and little free time to spare. Fortunately, there are a wealth of podcasts, audiobooks, and Youtube videos on skills such as sales, management, social skills, practical psychology, and more that you can listen to while you’re doing something else, such as eating breakfast.

About sales — knowing how to sell is one of the most powerful and versatile skills you can have in a bad economy. Not only can you use it to sell your own products and services, but you can use it to get a job or a promotion. The ability to sell is the ability to convince someone to do or believe something!

7. Work on yourself

Hand-in-hand with learning soft skills is working on yourself. An economic downturn can be rough on your mental health. Fortunately, you can become more resilient by learning how to manage your thoughts. A lot of the average person’s stress comes not from real events but from how the person thinks. If your imagination tends to scare you silly, you may want to read “Feeling Good: The New Mood Therapy” by psychiatrist David Burns, M.D.. Burns’ book takes the same cognitive behavioral approach often used by mental health professionals to treat depressed patients. It has been prescribed by psychologists as a form of therapy and may help you to save money and your peace of mind at the same time.

8. Learn how to budget

During a recession, money is more precious than usual. It may be extra difficult to make enough of it, and you can’t be sure that you won’t be laid off. It’s important to know how to stretch your money as far as it can go and save as much as you can.

You may carry an intimidating amount of student loan debt, and that might not be optional for you. Don’t make your situation worse by spending large amounts of money on things you don’t need. Be aware that the costs of little things, especially eating out, can add up very quickly!

If you graduate soon and find a good job soon after that, you may be tempted to buy the American dream at full speed. Think twice about buying a house or car right away. Remember, there are significant signs of a recession approaching. Focus on building a nest egg before you start competing with the Joneses. Your temperance may even reward you with some awesome deals if the recession lowers the prices of things you want!

9. Plan ahead for thrifty fun

Remember — the point of preparing for harder times is to preserve your happiness, not to scare yourself. The next recession might last only a few months, or it may take years; nobody knows what its duration or severity will be. Have confidence in yourself to have a good time, regardless. The next recession might be the pinnacle of your life if you make the most of it!

By splitting costs with others, you can have some amazing vacations for very little money, especially if you camp. Mother nature hosts free events year round, including meteor showers, lunar eclipses, spring flowers, and fall wind that you can’t beat for kite-flying. Public libraries offer endless hours of entertainment. Those who can afford it will still put up Christmas lights. There will still be lots of cheap hobbies you could get into, such as making things out of paper mache, geocaching, hiking, and sports. You’ll have plenty to do, and if you follow Step 2 in this listicle, you’ll be able to have your fun with friends.