Recovery Rebate Credit Allows Students to Claim Up to $1800

College students experience a myriad of adjustments during the time they spend in university. For many, this is their first time living away from the stability of their parents, and they must learn to provide for themselves financially. Some students eventually achieve financial independence, but because the process is often slow, they do not rush to claim themselves as independent on their taxes.

The first round of Economic Impact Payments, often referred to as “stimulus checks,” gave eligible adults $1,200 and an additional $500 for each additional dependent under the age of 17.

Tax Policy Center estimates that approximately 15 million dependant “[children] under 19” and “full-time student[s] under 24” were left out of this category. These dependents were also ineligible for the $1,200 and subsequent $600 Economic Impact Payment.

The Recovery Rebate Credit was created in order to compensate those who did not receive the first two rounds of the Economic Impact Payments. Students who were ineligible for the first couple rounds of stimulus checks may want to consider applying.

In order to receive this credit, students must claim themselves as independent – meaning they contribute to more than half of their living expenses – on their taxes. Before doing this though, students should consult their parent or guardian to understand what the change will mean for both themselves and their guardian, as it may not be beneficial in every case.

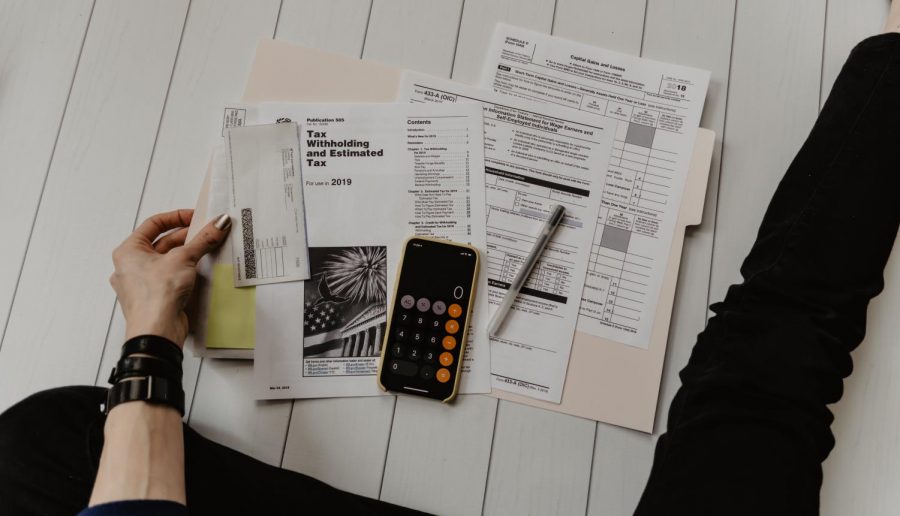

Once determining eligibility, students must fill out Form 1040 to receive up to $1,800, the sum of the missed stimulus checks. Several commercial tax services, including TurboTax, will automatically fill out this form if the individual indicates that they would like to receive the Recovery Rebate Credit.

Tax Day was originally April 15, 2021, but has been postponed to May 17, 2021, so students wishing to benefit from this credit should submit their taxes as soon as possible.

(She/her) Macy Frazier is a senior BFA Performance major at CSU. She is also pursuing a minor in Dance and a Theatre Education certificate. She began writing...